A key to understanding your workers’ compensation premium is the experience modification factor, also known as your mod. Understanding your company’s mod and the data used to obtain it helps you identify ways to minimize your workers’ compensation premium.

Most states use the National Council on Compensation Insurance (NCCI) to collect data and calculate the experience modification factor. The NCCI is a private corporation funded by member insurance companies. The remaining states either operate an independent workers’ compensation bureau or have set aside a state fund for workers’ compensation. These states may or may not use the NCCI’s classification system to determine experience modification factors.

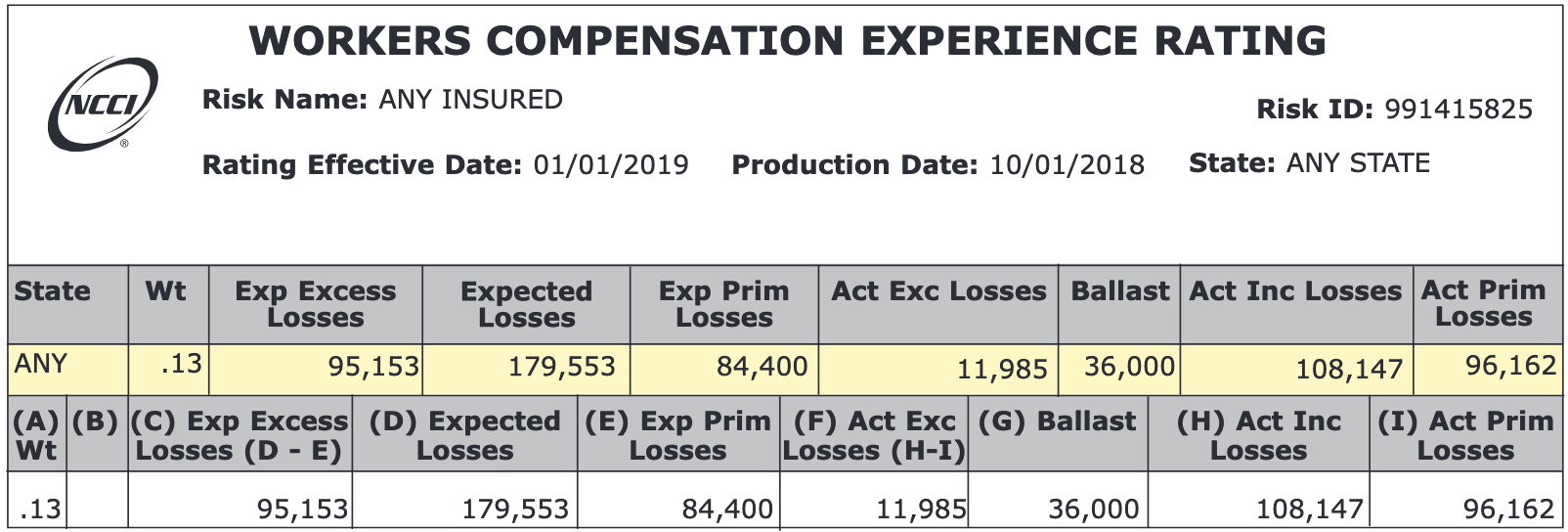

The process of calculating the experience modification factor is complex, but the underlying theory and purpose of the formula is straightforward. Your company’s actual losses are compared to its expected losses by industry type. The formula incorporates factors that account for company size, unexpectedly large losses, and the incidence of loss frequency and loss severity to achieve a balance between fairness and accountability.

How does my mod affect my premiums?

The mod factor represents either a credit or debit that is applied to your workers’ compensation premium. A mod factor greater than 1.0 is a debit mod, which means that your losses are worse than expected and a surcharge will be added to your premium. A mod factor less than 1.0 is a credit mod, which means losses are better than expected, resulting in a discounted premium.

What is the experience rating period?

The mod is calculated using loss and payroll data for an experience rating period. The experience rating period typically includes data for three policy years, excluding the most recently completed year. For example, if your anniversary rating date is Jan. 1, 2017, the experience period is 2012 to 2015. 2016 would be excluded.

Three years of data is used to provide a more accurate reflection of the losses, smoothing out the impact of an exceptionally bad or good year for losses.

Both actual and expected losses are divided into a primary and an excess portion in what is called a split rating method. Primary losses are designed to be an indicator of loss frequency (the number of losses) and are used at their full value in the mod formula. Excess losses are an indicator of loss severity (the amount of each loss) and are weighted in the formula so that they are less important. The emphasis of loss frequency over loss severity in the formula so that they are less important. The emphasis of loss frequency over loss severity in the formula reflects the fact that loss frequency is a more significant indicator of risk and can be improved through proactive loss control programs.

In July 2011, the NCCI announced a proposal to raise the split point from $5,000 to $15,000 over a three-year period to better correlate with claims inflation. The process of transitioning to the new split point began in 2013, with an increase in the split point from $5,000 to $10,000. In 2015, the split point included an additional increase as a result of claims inflation, and the NCCI now makes annual adjustments to the split point based on inflation.

In 2017, the NCCI’s rating system will use a split point of $16,500. This means that the first $16,500 of every loss is considered a primary loss, and any amount over this point is considered an excess loss. For example, a $9,000 loss would have no excess losses, as it falls below the current split point of $16,500. However, a loss of $25,000 would have $16,500 in primary losses and $8,500 in excess losses. Additionally, medical-only claims figures may be reduced by 70% in approved states.

Expected losses are calculated using your payroll data by state and class code and applying the expected loss rate (ELR). The ELR is provided by each state’s rating bureau. These figures are also broken down into expected primary losses and expected excess losses.

The final mod calculation compares your actual primary and excess loss figures to those expected for a company of the same size and industry type. To understand how workers’ compensation losses at your business compare to state industry averages, contact Magnolia Insurance Group to review your experience modification worksheet.

Your mod factor has a direct impact on your workers’ compensation premium. The key to controlling your insurance costs is accident prevention.